T&H CX > Insights > Customer Experience Insights > Unlocking customer v...

Today's edition is the second part of our latest whitepaper. If you like what you read, you can download the full whitepaper for free here.

We all know of Pareto’s 80/20 principle, whereby 80% of business revenue often comes from a far smaller proportion (e.g. 20%) of a brand’s customer base.

If the old business adage is true, knowing who your most valuable customers are is crucial for understanding which customers are worth your time, money and effort.

So how do you find the customers that will be loyal in both the good economic times and the bad economic times?

The customers that will tell us when we’re not at our best, the customers that will always reply to our late night eDMs?

There are a few methods brands use to sift through their customer base to find their most valuable members. Some ways of measuring value are good, some are better but ultimately there is one that incorporates them all.

Fueled by transactional data, current commercial value is the process of valuing customers based on how much they have historically spent at the proverbial ‘register’ minus how much it costs to get them there.

These are the tangible figures that most marketers are familiar with when it comes to measuring the ROI of their efforts. But while current commercial value demonstrates a customer’s value today, it doesn’t indicate whether or not that customer will be as valuable in the future.

Once you’ve got a clear understanding of current commercial value, it’s time to supplement that approach with potential commercial value - an even more nuanced approach to customer value.

Potential commercial value refers to the customer’s potential revenue and profitability based on their current ability and future propensity to purchase. Understanding the potential value a customer can bring to your business is imperative to a business that wants to get smarter with where to invest effort and budget.

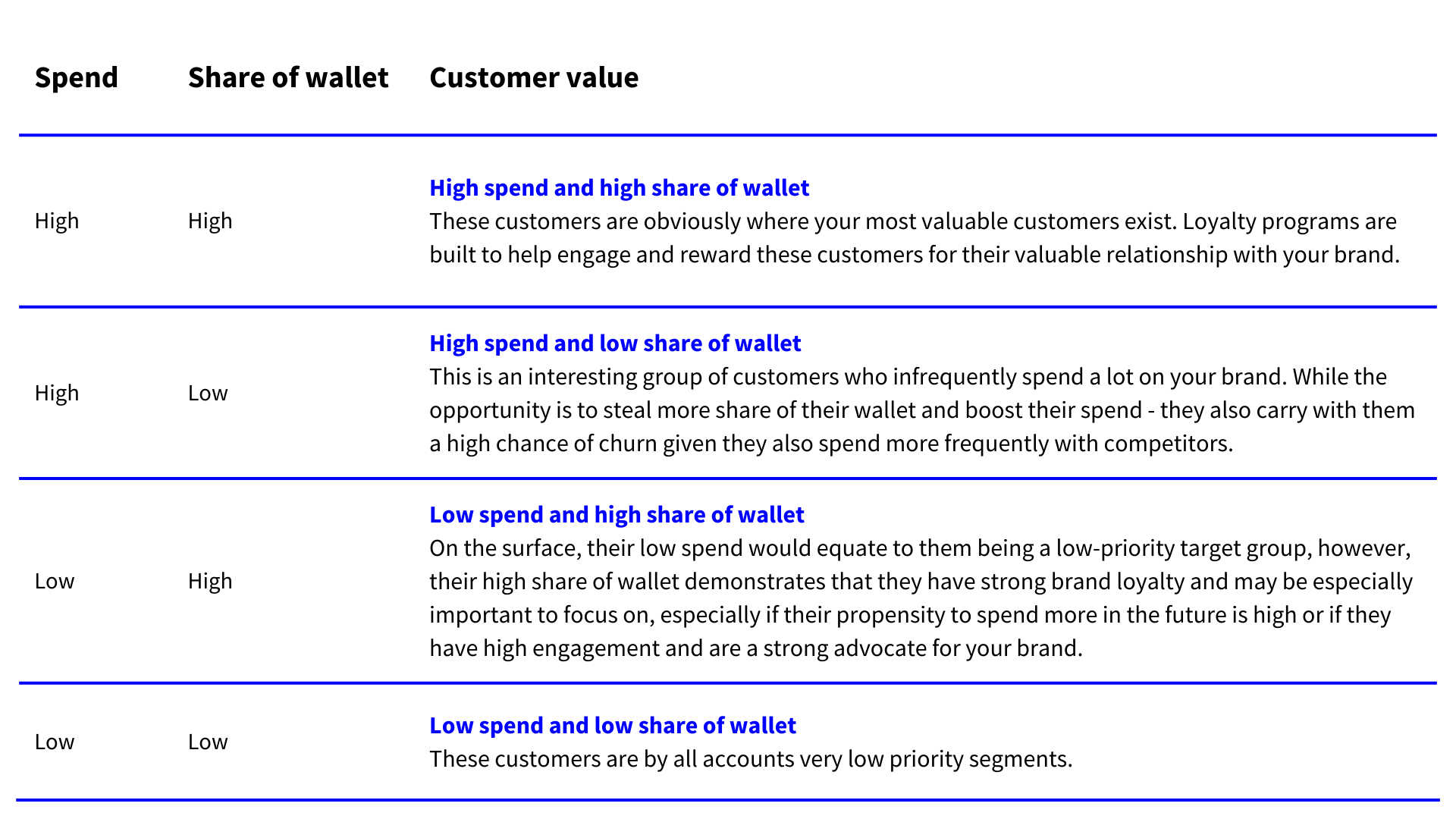

The first concept to unpack in this equation is “current ability.” Measuring how much a customer spends with you is only half the story. What is far more interesting is what they could be spending. Share of Wallet (SOW) is the key concept here.

SOW is the dollar amount an average customer regularly devotes to a particular brand rather than competing brands in the same product category. By breaking down customers based not on how much they spend, but by what percentage of their wallet they spend with your brand, you can get a clearer view of which customers are truly valuable.

Future Propensity

Future Propensity“Future propensity” involves predictive modelling used to identify customers with the propensity to demonstrate new behaviours. These models are based on aggregating a range of potential data inputs which can build a unique understanding of the key attributes, typical actions, and moments which may influence a customer’s ability to be sold to, engaged or retained when at risk of churning.

Some of the potential data inputs which may be considered for a propensity model could include:

.png?width=1920&height=1080&name=Spend%20(1).png)

Together, current ability and future propensity metrics give brands a brighter picture of the customers that aren’t just valuable today, but valuable tomorrow. But there is still one final layer of value to consider in order to completely understand the value of your customers.

Ultimately, the key to understanding who your most valuable customers are is to combine the current and future commercial value of a customer with a broader overlay.

Despite being dismissed as ‘soft’, engagement metrics that may track a customer’s data health, comms engagement, digital product usage or social media activity are incredibly important for identifying which of your customers are brand advocates - and are likely to be highly valuable ‘promoters’ when calculating NPS.

These customers engage with your brand on both a commercial level and an experience level and are likely to be the ones who will demonstrate long-term loyalty and deliver increased Customer Lifetime Value.

Due to their affinity with and advocacy for your brand, they are also a primary source for referrals - an immensely undervalued segment of most customer bases. A study by Wharton and Goethe German Banks states that referred customers have 25% higher profit margins than non-referred customers. This is largely due to referral customers costing less to acquire and their increased likelihood to spend more and more frequently than customers that are acquired through paid marketing initiatives.

Lastly, and most importantly, understanding a customer’s engagement not only gives you a more holistic understanding of their true value, it also enables you to take a more customer-centric approach as a brand and a business, by delivering a more personalised and relevant experience.

There is no ‘one size fits all’ answer to this question but what has become increasingly important is to recognise all of the ways that a customer demonstrates and creates value for your business. This means looking beyond just the dollars and cents. It also means considering potential future value in combination with an historic view.

And by attracting these valuable customers and turning them into brand advocates, you have a recipe for driving sustainable future growth.

Combined with more complex CRM technologies and new accounting methodologies like earned growth, increasingly there are more ways of validating and understanding the true value these brand advocates bring to your business. But unless you’re willing to dive deeply into the ‘softer’ data, brands will continue to undervalue their most valuable customers not just today, but also tomorrow.

.png?width=1920&height=1080&name=Recipe%20card%20(4).png)

Founding Director of Tortoise & Hare, Oliver is passionate about helping customer-first brands build valuable relationships. A senior specialist across our strategic and brand services, he is passionate about developing practical solutions that drive growth, engagement and loyalty.

Founding Director of Tortoise & Hare, Oliver is passionate about helping customer-first brands build valuable relationships. A senior specialist across our strategic and brand services, he is p...

Keep up to speed with insights from the frontier of customer marketing in Australia.

Explore how UX design extends far beyond aesthetics to encapsulate an entire human-centered design philosophy which optimises the user experience.

When done right, customer loyalty programs play a critical role in nurturing customer loyalty and growing customer lifetime value for the business.

Discover the role of Customer Experience (CX) in 2025, its strategic importance, technological integration, and the emerging trends shaping business success.

If you’re looking to build engagement at every touchpoint of your customer’s journey, we’d like to help.